By Grace Sutton

TAX TIP:

As children grow into adulthood, their financial independence often comes in stages. One of those stages? Filing their own tax return. If you’re a parent who’s still paying for your child’s education or supporting them financially, you may want to keep this tax tip in mind…

THE SCENARIO WE OFTEN SEE:

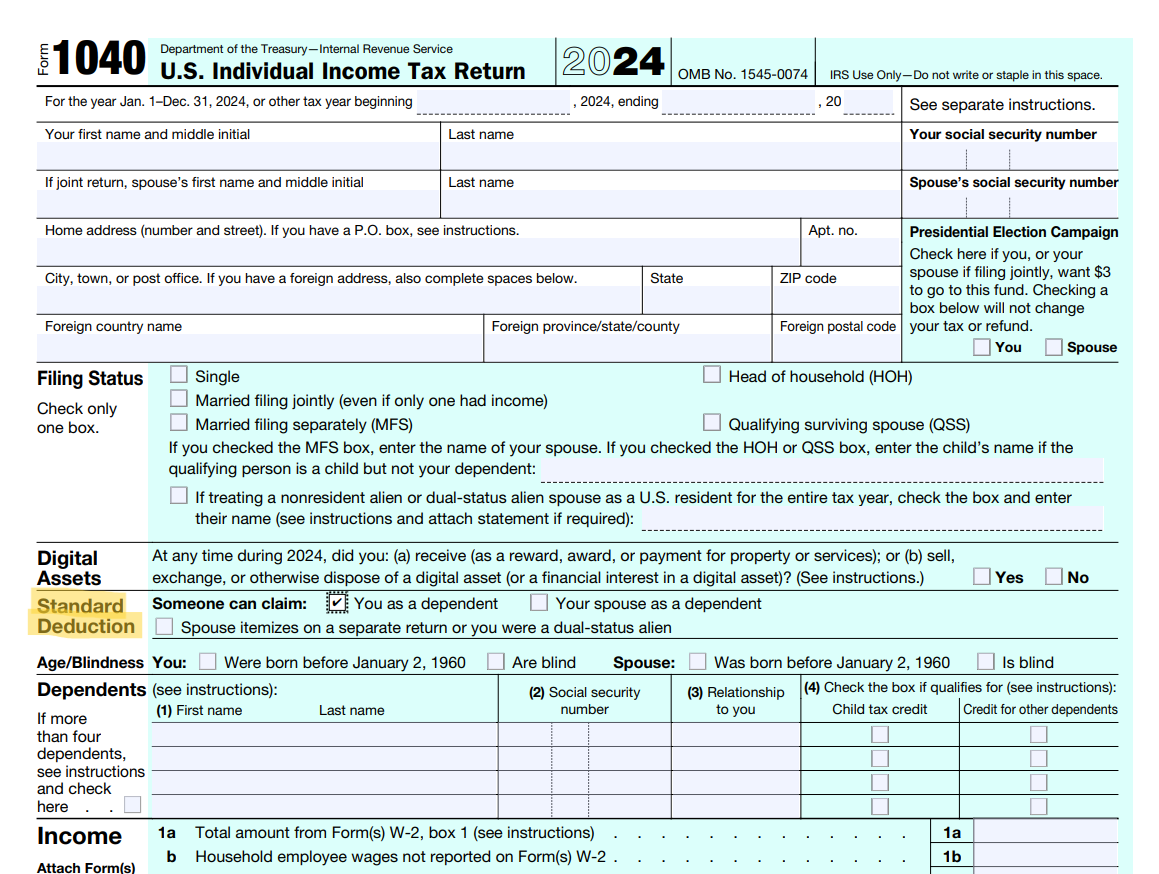

Your child (who relies on you financially in some way) files their own tax return. They don’t check the box that says “Someone else can claim me as a dependent,” and consequently claim themselves. This prevents parents who want to claim their kids as dependents from being able to do so.

In most cases, parents can claim a child as a dependent up to age 24 if they’re a full-time student and the parents provide more than half of their financial support — but not if that child files a return and claims themselves by mistake.

WHY IT MATTERS:

Unfortunately, not checking the correct box can have real tax consequences, creating a conflict in the IRS system.

The IRS receives two returns with conflicting information:

- A return from the parents, who claim the child as a dependent

- A return from the child, claiming themselves

What’s the result of this mix-up? A rejected return and an error message along the lines of: “This taxpayer has been claimed as a dependent on another return.” or

“Primary or spouse has already been claimed.” These messages often catch families off guard.

THE FIX ISN’T ALWAYS SIMPLE

If your child claims themselves incorrectly, their return will need to be amended. That process takes time and can delay your refund. The best solution? Communicating with your child on how to correctly fill out that portion of the return.

- Communicate ahead of time with your child:

Have the conversation early, explaining that you plan to claim them as a dependent — and that they must check the box affirming that.

- Explain what “claiming” means:

Walk them through it or send them a quick reference, like the image below. The section highlighted shows the exact checkbox that must be marked.

- Communicate with your tax preparer:

If your accountant files both returns (yours and your child’s), this usually doesn’t happen. If your child is filing independently, this issue can occur.

CHECKLIST:

Before your child files their return:

- Talk to them about your plan to claim them as a dependent

- Make sure they check the correct box

- Confirm how they are filing (TurboTax, an accountant, etc.)

If DHA is filing both returns:

- You’re in the clear — we will handle this.

If your child already filed incorrectly:

- See if an amendment is needed

- Expect potential delays for your return

- Set a reminder for next year to talk with your child about claiming them

WHEN DHA FILES FOR YOU, YOU’RE COVERED.

This issue is unlikely to occur if you have an accountant who files both your return and your child’s return. If we’re filing for your family, we’ll ensure every box is checked correctly — and your eligibility to claim your child as a dependent is protected.

If you’re unsure of where you stand or have questions, reach out to us. We’ve sorted through these issues countless times before, and we’re here to help you avoid them.